Risks Under Control: Modern Collateral Monitoring for Banks from VIEWAPP

For a bank, issuing a loan against collateral is always a balance between trust and risk. The asset in the contract provides security, but its real value is volatile. It can depreciate due to unforeseen circumstances: from simple equipment wear and tear to force majeure or fraud.

Traditional control through on-site inspections solves the problem but creates its own: it is costly, time-consuming, and often lags behind real-time. The bank receives data with a delay, which means it reacts with a delay. Conversely, monitoring based solely on the borrower's goodwill and their photo reports, without proper verification, is not a solution but a new threat. Transferring the responsibility for recording the asset's condition to the counterparty without any verification mechanisms opens the door to abuse.

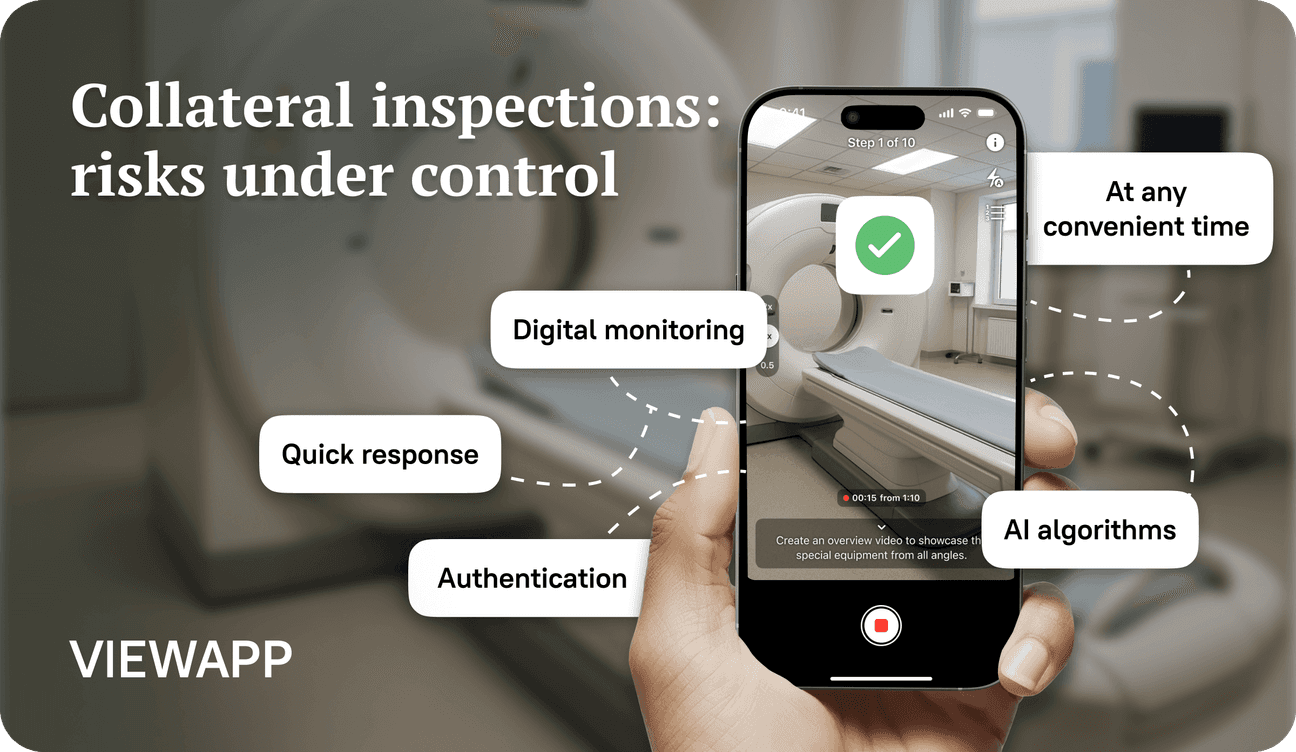

We offer a fundamentally different approach—a controlled digital environment for monitoring.

The VIEWAPP system doesn't just collect media files from the borrower; it ensures complete control over the process of their creation and reliability.

How do we ensure security and objectivity?

The process is bank-managed. The initiation of each inspection, its frequency, and parameters are set from the risk manager's personal dashboard. It is not the borrower who decides when and what to show, but the bank—what and when needs to be checked.

Data is protected from substitution. Our mobile application captures photos and videos strictly in real-time, preventing the upload of pre-existing files from the device's memory. Each file is automatically tagged with digital markers: geolocation, precise time, and device data.

Artificial intelligence checks for anomalies. Algorithms analyze the received footage for compliance with the benchmark and immediately signal any deviations.

Thus, we minimize the human factor from both the borrower's and the inspector's side. The bank receives not just files from the client, but verified and objective information on which to base informed decisions.

The VIEWAPP system becomes the bank's remote eyes, operating in real-time. Its strength lies in the combination of simplicity for the user and powerful analytics for the risk manager.

How does it work?

- At the collateral registration stage, a digital profile is created—a benchmark photo and video report tagged with location and time. This is the starting point.

- Subsequently, monitoring becomes regular and remote. The borrower or an inspector, at the bank's request, records the object's condition via a smartphone in minutes. The system automatically checks the received materials for authenticity and relevance, detecting any manipulations.

- Using algorithms, we analyze changes that signal potential risks. This allows us to not just collect data, but to immediately understand what is happening with the asset: everything is in order or attention is required.

Key benefits for the bank

- Risk reduction through the prompt detection of changes in the collateral's condition.

- Resource savings by reducing inspector site visits and paperwork.

- Transparency: A complete, verifiable history of all control stages in a single system.

- Customer convenience, as they undergo inspections quickly and at a convenient time, improving their relationship with the bank.

VIEWAPP is not just software; it is a new standard for working with collateral assets. We transform it from a risky clause in a contract into an object that can be seen, controlled, and managed with confidence.