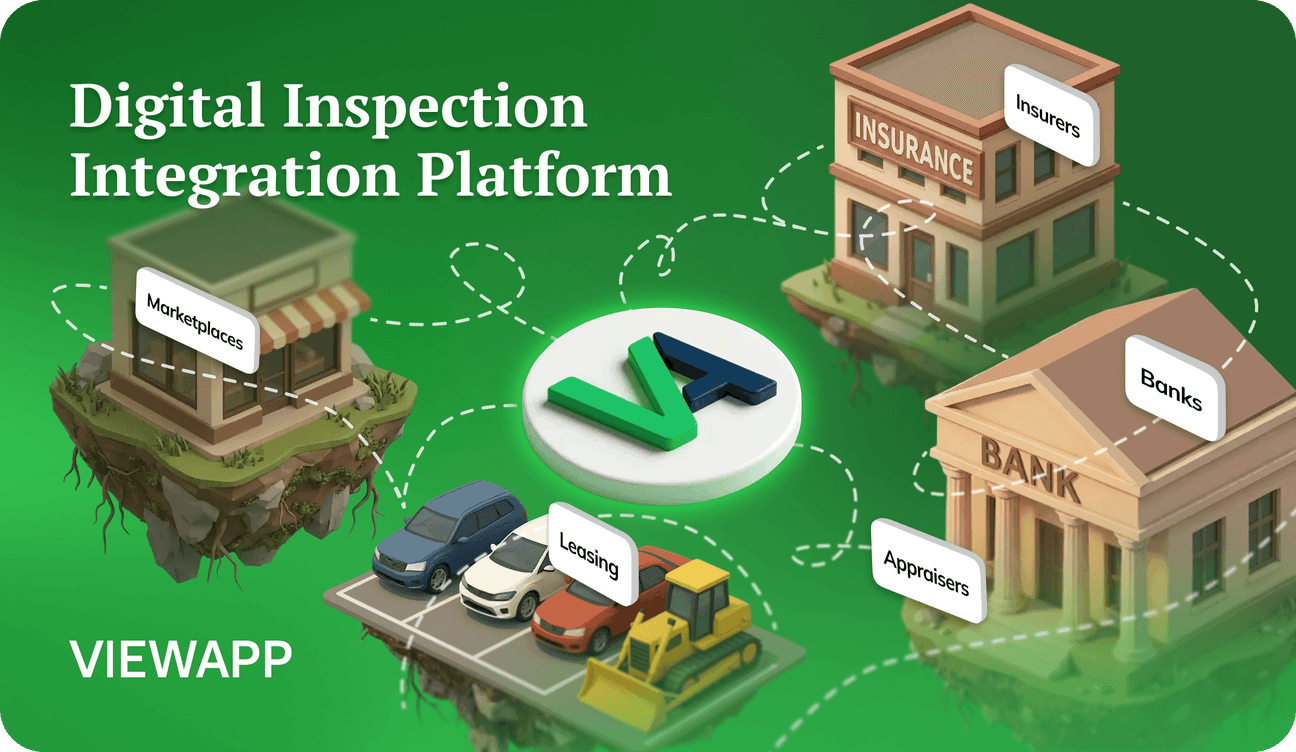

The VIEWAPP Integration Model: How One Platform Unites Markets

The inspection market today is fragmented. Banks, leasing companies, appraisers, insurers, and marketplaces often work with the same assets but through different tools, data formats, and processes. As a result, each player builds its own infrastructure, duplicates inspections, repeats the same actions, and incurs redundant costs—time, operational, and financial.

It has now become evident that the market requires a connecting layer between its participants.

This is the role VIEWAPP is increasingly playing—not merely as an intelligent digital inspection service, but as an integration platform capable of connecting different sides of a single process.

Where the Gap Arises

Consider a typical interaction: a bank and an appraisal company. The appraiser works with banks, prepares reports, confirms an asset's condition, conducts or arranges inspections. Yet:

- Some banks already use VIEWAPP for their own tasks (collateral, monitoring, control).

- Others still operate with their own processes.

The appraiser must adapt to each client individually.

Consequently, the same asset may be inspected multiple times, data is transferred in different formats, and authenticity control depends on who initiated the inspection.

An Integration Approach Instead of Disparate Solutions

VIEWAPP's integration model allows for building a unified inspection space for all participants in the chain—without disrupting existing processes or forcing an immediate, mandatory transition for all parties.

The logic is simple. For example, if a bank already uses VIEWAPP, the appraiser gains access to inspection scenarios within the bank's framework:

- The inspection is conducted according to the bank's standards.

- Data immediately enters the bank's ecosystem.

The appraiser operates in their familiar role, but without unnecessary coordination or repeated assessments.

If a bank does not yet use VIEWAPP, the appraiser can initiate the inspection independently:

- Using the same technology.

- Obtaining secured, verifiable materials.

- Delivering the results to the bank in a clear and verifiable format.

VIEWAPP becomes the appraiser's individual working tool with potential for further multi-integration.

The technology remains the same—only the access framework and model change.

What This Means for the Market in Practice

The example of the bank and appraiser is just one of the most illustrative scenarios. In practice, similar overlaps occur between insurers and banks, leasing companies and marketplaces, property managers and developers, monitoring services, and internal control functions within large corporations. In all these cases, the asset is the same, but the number of parties involved around it is growing. VIEWAPP's integration model scales to any such chain, enabling the creation of multi-party workflows without inspection duplication, fragmented data, or process conflicts.

This approach solves several systemic problems at once. First, it eliminates inspection duplication. One asset—one inspection, accessible to all necessary parties.

Second, it standardizes data quality. Regardless of the initiator—bank or appraiser—materials are collected using unified protocols and undergo identical verification.

Third, it simplifies scaling. A bank doesn't need separate integrations with dozens of appraisers, and an appraiser doesn't have to maintain different formats for each client.

Finally, it introduces a flexible monetization model where each participant pays precisely for the role they play in a specific transaction.

VIEWAPP as the Connecting Link

The core value of VIEWAPP in this model lies not in individual features, but in its ability to serve as a neutral technological foundation for different market participants.

The platform does not replace bank processes, compete with appraisers, or displace existing roles. It connects them into a unified digital logic where:

- Data is collected in a consolidated manner.

- It is automatically verified.

- It is reused multiple times.

- And it remains protected from manipulation.

This is how VIEWAPP becomes an infrastructure integrator—that very missing layer that enables the market to operate faster, simpler, and more transparently.

In our example, we examined the interaction between a bank and an appraiser. However, in reality, such multi-party connections permeate the entire financial and insurance market: insurers, leasing companies, marketplaces, property managers, monitoring, and control services all work with the same assets, but for different reasons and at different times.

VIEWAPP's integration model scales to any such scenario, allowing all participants to rely on a single, verifiable source of visual data. As a result, the market gradually moves away from disparate point solutions towards a common data exchange infrastructure.