VIEWAPP in insurance: why do we protect digital inspections from fraudsters?

Inspections in insurance are extremely important – they are performed to obtain objective information about the condition and location of objects for underwriting and claims settlement. But does the insurance company always receive accurate data, especially if inspections are not yet digitised with adequate protection against fraud?

As our practice shows, attempts at insurance fraud during inspections are a frequent occurrence, and if they are successful, they result in significant losses amounting to thousands. Take, for example, a premium class car, where during a pre-insurance inspection, it is replaced with a similar car without damage, and then a claim is filed for payment — a very unpleasant situation, which without special technology can easily be overlooked by the insurance company, with further unpleasant consequences.

Or another example: when inspecting an apartment for property insurance, photos of someone else's property are submitted, taken in advance or downloaded from the Internet. Without digital recording of

- geolocation,

- date,

- time

- data integrity control ,

such a case is almost impossible to detect immediately. And after an insured event occurs, it turns out that the insured object was not the one that was insured, or was not in the condition it was in at the time the contract was concluded.

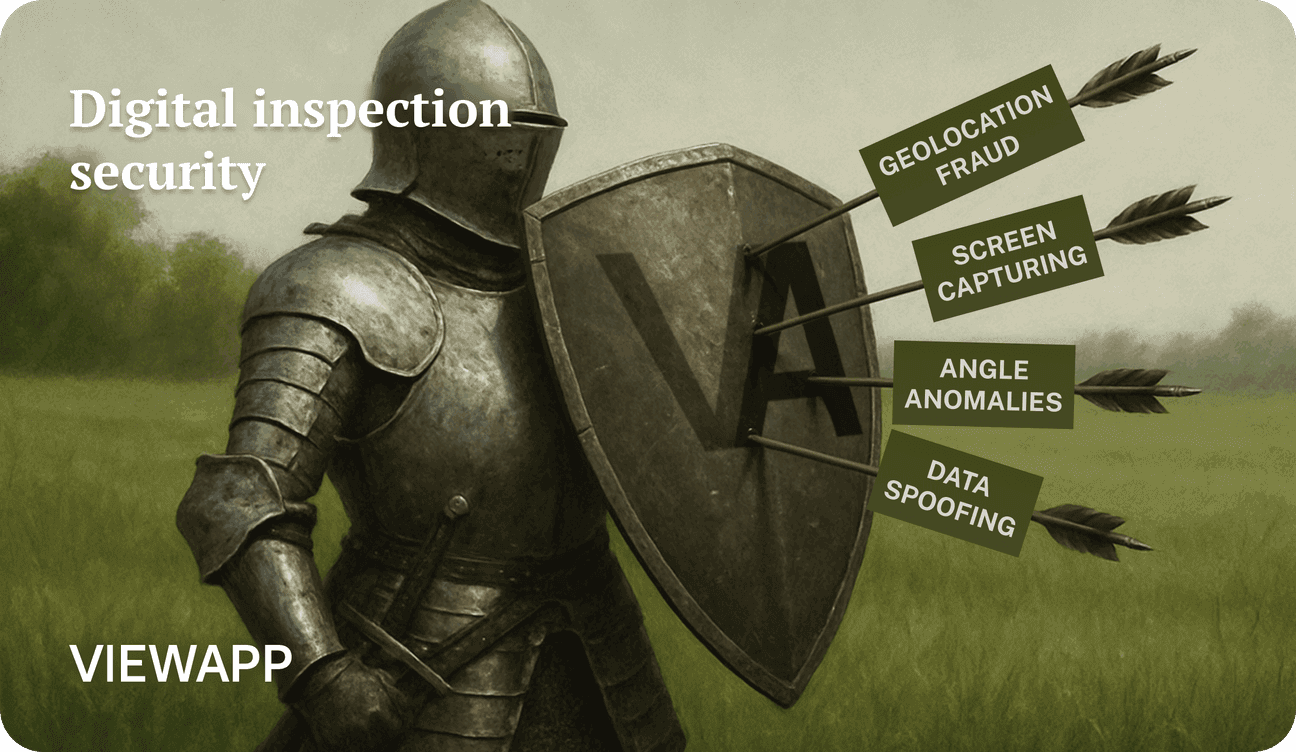

The digital inspections offered by VIEWAPP eliminate these risks. VIEWAPP puts the protection of digital inspections against fraud at the centre of its technology.

We record the metadata of each frame, protect photos and video streams from tampering, and use AI detectors to verify the logical sequence of the inspection. This means that neither the object, nor its damage, nor the time or place of shooting can be falsified without a trace. Moreover, intelligent algorithms analyse anomalies in user behaviour, route, shooting duration and other parameters, allowing suspicious attempts to circumvent the rules to be detected before damage occurs.

For an insurance company, this means not just protection against individual fraudsters, but a systematic reduction in losses and an improvement in the quality of the portfolio. And for honest customers, it means a guarantee that their interests will not be harmed by others' attempts at fraud: when all inspections are conducted with fraud protection, the insurance company reduces real risks and can keep rates at a fair level without having to raise them due to high levels of potential damage. As a result, honest customers do not overpay and receive not only an objective price, but also additional comfort — transparent procedures, quick decision-making and confidence in the reliability of the process.

We are convinced that insurance should be based on reliable data, not on vulnerable practices and fragmented approaches. VIEWAPP fights fraud systematically — not only at the product level, providing technological protection for digital inspections, but also at the standardisation level, forming uniform principles and requirements for the digital process in the industry.

So, protecting digital inspections from fraud gives insurance companies:

- Reduced losses by eliminating unreliable data and false claims.

- Improved insurance portfolio quality thanks to objective data and transparent processes.

- Reduced time for underwriting and settlement decisions.

- Reduced verification costs – VIEWAPP digital inspections are significantly more economical than traditional practices.

- Protection of the insurer's reputation – fair processes strengthen the trust of customers and partners.

- Favourable rates and comfort for conscientious customers who do not overpay due to others' attempts at fraud.

- A systematic approach to combating fraud — time-tested and user-proven technology.