VIEWAPP: Independent Object Verification to Prevent Insurance Fraud

The insurance industry is under constant pressure from fraudsters employing increasingly sophisticated schemes. These range from falsifying documents and misrepresenting circumstances to manipulating visual evidence. For insurers, this translates into direct financial losses, while honest clients face higher premiums and more complex procedures.

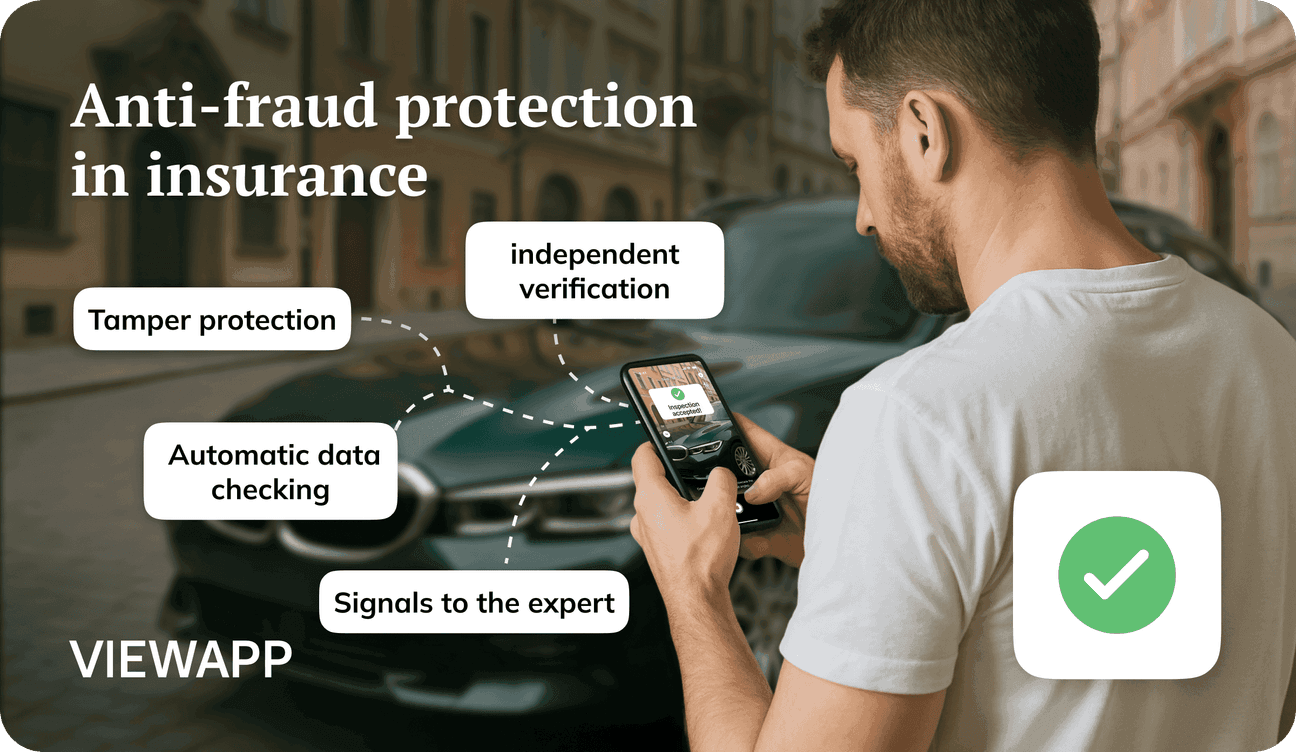

The solution lies in transitioning from reliance on paper documents to objective digital verification. VIEWAPP offers independent object verification and automated data validation, effectively neutralizing most traditional fraud tactics.

Real Case: Manipulated Vehicle Photos in the UK

In the UK, insurers Allianz and Zurich UK have reported a significant rise in fraudulent claims involving manipulated vehicle photos. Fraudsters use software to edit images, adding fake damage to vehicles, thereby inflating claims. Allianz noted a 300% increase in such incidents between 2021-2022 and 2022-2023 – so we see that its trend. Zurich UK also observed a surge in claims doctored with "shallowfake" technology, which is becoming a major concern for fraud prevention teams. (The Guardian)

How VIEWAPP Prevents Such Fraud

- Photo and Video Verification with Time and Location Stamps: Each photo and video during the object inspection is tagged with timestamps, geolocation, and digital signatures, making it impossible to use altered or third-party images.

- Automated Authenticity Checks: The system analyzes images for signs of manipulation, such as duplicated elements, lighting inconsistencies, and damage patterns that don't align with real-world physics.

- Cross-Referencing with External Databases: Materials are cross-checked against previous inspection records, public databases, and insurance claim registries to identify discrepancies.

- Eliminating Agent Manipulation: All inspections are conducted through a secure channel, preventing agents or clients from altering data. Even attempts to upload third-party photos are flagged by the system.

Outcome

In the aforementioned case, the fraudulent use of manipulated photos would have been detected early. VIEWAPP's system identifies inconsistencies, alerts experts to suspicious materials, and ensures transparency in the process.

For insurers, this means reduced losses and protection against fraudulent claims. For clients, it fosters trust in the insurance system, ensuring that the premiums of honest participants aren't exploited by fraudsters.

VIEWAPP enhances the security of the insurance market: digital verification, automated checks, and integration with external data sources transform the insurance process into a transparent and secure system, rendering fraud unprofitable.